Vidhwa Pension Yojana List Status: The following article is on Vidhwa Pension Yojana in state of Uttar Pradesh. The article covers the महिला पेंशन योजना list, how to apply online, vidhwa Application status. Applicants are advised to go through the article completely. The Government of Uttar Pradesh has started a good scheme to help widowed women (विधवा महिला). This scheme is for destitute widows (विधवा महिला) age between 18 to 60 years living below the poverty line. Under this scheme (योजना के तहत), an amount of 300 rupees (300 रूपए के धनराशि) is given every month (प्रत्येक माह) for cooperation in living and fulfilling basic needs.

The Widow Pension Scheme in Uttar Pradesh is a welfare scheme. Uttar Pradesh government also gets help from the central government in this scheme under NSAP. For this, the online or offline application can be made. This scheme of the Uttar Pradesh government has brought a lot of relief to poor widowed women.

Vidhwa Pension Yojana 2020

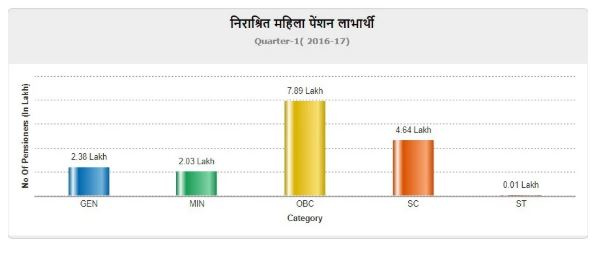

In the first quarter of the widow pension scheme following no. of beneficiaries under mentioned category have been covered

| Category | No. of people |

| General | 2.38 lakhs |

| Min | 2.03 lakhs |

| OBCs | 7.89 lakhs |

| Schedule Caste | 4.64 lakhs |

| Schedule Tribe | 0.01 lakhs |

Vidhwa Pension Yojana Eligibility

- To take advantage of the scheme, the age of a woman should be between 18 and 60 years.

- Only widow women of Uttar Pradesh can apply for this.

- If the applicant has remarried after the death of the husband, there will be no benefit

- The applicant(लाभार्थी) is not getting the benefit of other government schemes like UP old age pension scheme

- The widow’s(विधवा) children should not be adults, even if they are adults, they should not be able to maintain.

Pension rate (पेंशन दर)

The beneficiary(लाभार्थी) will get a pension of Rs 300/- per month and after attaining the age of 80 years the beneficiary will get Rs 500/- per month.

Sanction of Pension amount

The amount of pension to the beneficiary(लाभार्थी) will be only allotted after the details of the beneficiary are uploaded in the record in the website.

Credit of Pension

The amount of pension will be credited directly in the bank account of the beneficiary or it can receive through the post office whichever of these is convenient to the beneficiary.

Discontinuity of pension

The pension of the beneficiary will be discontinued if

- There is a case of remarriage of the beneficiary

- If the beneficiary is gets above the below poverty line

Also Check: PM Kisan Samman Nidhi

उत्तर प्रदेश विधवा पेंशन योजना दस्तावेज पंजीकरण

Following is the list of documents (दस्तावेज) required for registration for vidhwa pension scheme

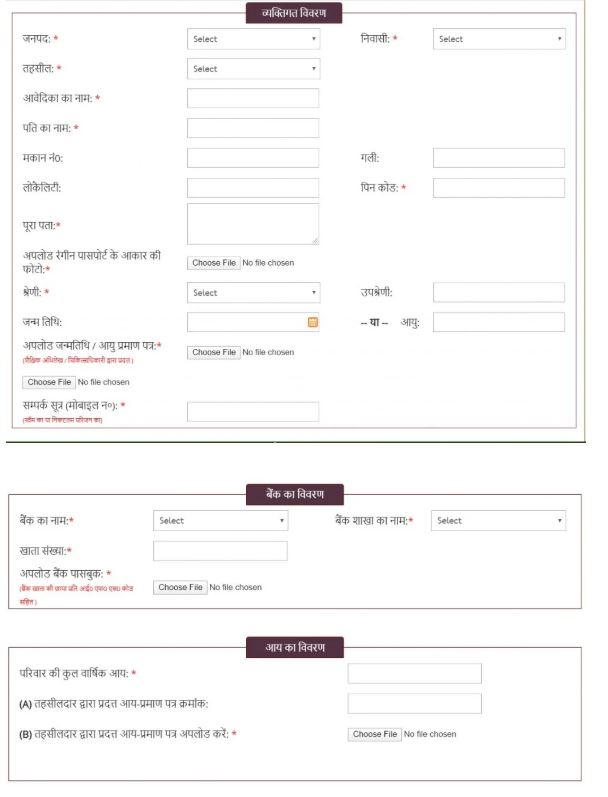

- Applicant photograph in JPEG format.

- Birth Certificate

- Id proof (voter card/ aadhar card/ ration card)

- Bank passbook

- Income certificate (आय प्रमाण पत्र)

- Death certificate of husband (मृत्यु प्रमाण पत्र)

Key point while uploading the documents

- The photograph of the beneficiary should be in JPEG format. The maximum size of photograph should not exceed 20 kb.

- The birth certificate should be in JPEG or PDF format. The maximum size for birth certificate is 100 kb.

- The id proof should be in JPEG or PDF format.

- The bank passbook should be in JPEG or PDF format.

- The income certificate should be in JPEG or PDF format.

Vidhwa Pension Yojana Application Procedure

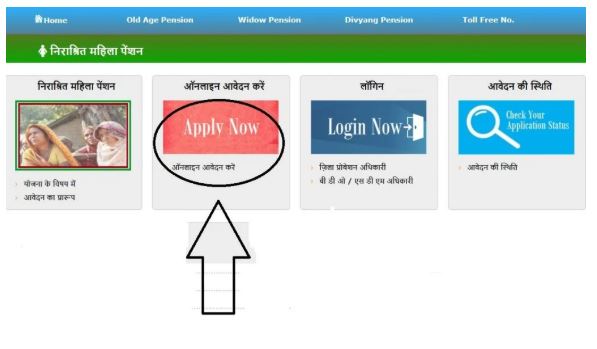

Step 1: visit the official site at www.sspy-up.gov.in. (साइट पर लॉगिन करे)

Step2: Click on apply now as shown in the picture above.( Apply now पर क्लिक करे)

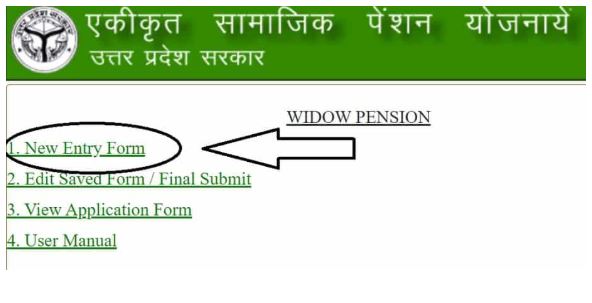

Step 3: A new page will appear on your screen. Click on New entry form.( नए आवेदन पत्र पर क्लिक करे)

Step 4: Enter the personal details, bank details, income details and spouse death detail asked in the form. Select the checkbox and enter the captcha and finally click on save button.( सभी महत्वपूर्ण जानकारी फॉर्म में भरे)

Step 5: After the form is saved successfully, the registration no will be generated. ( आवेदन पत्र को सेव करे)

Step 6: Save the generated no for reference. ( आवेदन संख्या को सुरक्षित रखे)

Step 7: After this check for any error in the form and if everything is correct in the form then click on final submit. (किसी भी प्रकार की गलती को सुनिश्चित करे और final submit kare)

Step 8: view the form and click on final submit. (final submit button पर क्लिक करे)

Step 9: take a print of the application form submit it to the office of DSWO/DPO/DHWO within the tie period of one month.

The application form (आवेदन पत्र ) can also be availed( प्राप्त ) at the office of Block Development Officer of the district (खंड विकास अधिकारी).

Click here to download the application form.

The beneficiary(लाभार्थी) residing in village or rural areas has to submit the application at village gram sabha (ग्राम सभा) and those residing in urban areas will have to submit application at जिला प्रोबेशन अधिकारी कार्यालय.

UP विधवा पेंशन योजना लिस्ट 2020

The beneficiary (लाभार्थी) list will have to login through the password to know the status of his application.

- Creating Login Password

If the beneficiary(लाभार्थी) password is not with the beneficiary, then they have to create a password. For the status of the application, select the option of “Registration” for registration. Select the scheme displayed in that screen, then fill in your registration number(पंजीकरण संख्या ) and account number(खाता संख्या) (as shown in screen 1 below) and finally fill the captcha and click on the submit button.

- Changing the password on the first login while logging in with the login password.

In the process of creating a login password for the first time, the password received will have to be changed on the first login.

Process

- To apply for the application, fill in the registration number (पंजीकरण संख्या) and the password received in the registration for the first time and click on the “Log in With Password” button.

- To change the password, fill the details of your current password and carefully keep the changed password with you.

- To know the status of your application (आवेदन की स्तिथि), click on the “Know the status of your application” option.

- Select the scheme displayed in that screen, then select your registration number.

- You can know the status of the application by logging in with your changed password.

National Social Assistance Programme

The National Social Assistance Programme (राष्ट्रीय सामाजिक सहायता कार्यक्रम) is central government funded scheme which helps to provide the financial aid in the form of pensions to the old age people, widows and disabled people which generally comes under the category of below poverty line.

Article 41 of the Indian Constitution states that:

“The State shall, within the limits of its economic capacity and development, make effective provision for securing the right to work, to education, and to public assistance in cases of unemployment, old age, sickness and disablement, and in other cases of undeserved want.”

Key principles of the Scheme

- To cover every eligible person or families of the deprived section of the society irrespective of caste, creed and colour.

- To make the scheme accessible to each and every beneficiary and maintain transparency in the process.

- To provide the aid to the beneficiary in the form of pension on monthly basis on time.

- To make the mode of payment of pension directly in the account of beneficiary.

The NSAP consist of the following schemes:

At present there are 5 schemes in under NSAP which are as follows

- Indira Gandhi National Old Age Pension Scheme (IGNOAPS)

- Indira Gandhi National Widow Pension Scheme (IGNWPS)

- Indira Gandhi National Disability Pension Scheme (IGNDPS)

- National Family Benefit Scheme (NFBS)

- Annapurna Scheme

Vidhwa Pension Implementation

Awareness regarding the Scheme

The first and the foremost task about the NSAP schemes is to aware the people about the scheme, the eligibility conditions for it, financial assistance covered in the scheme, and the process for application of the scheme. The district and block level authorities are liable to spread awareness of the scheme at the grass root level.

Record of Existing Beneficiaries (मौजूदा लाभार्थियों का रिकॉर्ड)

The concerned authorities should check for the records for existing beneficiaries so as there is no misuse of the financial assistance covered under the scheme. Also, evaluation of existing record will help to figure out the beneficiaries that are need to be covered or not so as to maintain a degree of transparency. The authorities have to check and collect the details of beneficiaries of other existing schemes. After the evaluation if there is any discrepancy found, the beneficiary name to be deleted or amended by the authorities.

Identifying New Applicants

The task of identifying new beneficiaries is on the shoulders of village panchayat/ municipal authorities. The beneficiaries can be selected from the below poverty line list. The beneficiary has to enrol through application form made available by the local authorities charging free of cost and also to make it available at the state government website. The relevant document for birth can be 10th class marksheet, age mentioned on ration card or any govt certified document other than birth certificate. The widows have to submit the death certificate issued by the authority of their husband in order to avail the financial aid covered in the scheme.

Beneficiary Verification

The concerned authority will verify the details submitted by the applicants and a verification team can also visit at the applicants address for inspection.

Time Duration for Application Processing

The time taken for application processing to finalising it can take maximum time period of 2 months depending on verification and other formalities.

Beneficiary record

The Gram panchayat/ Municipal office has to disclose/publish the list of the beneficiaries to which pension has been credited, at their office and also to update the beneficiary list in every 3 months.

Also Check: National Scholarship Portal

Share your views, suggestion and queries related to Vidhwa Pension Yojna in the drop box below.

FAQs